Investing in little-known “unsexy” businesses that “underpin our quality of life” is proving a winning strategy for a unique firm backed by some of Australia’s wealthiest and most successful individuals and families. So much so that private equity fund Straight Bat has big expansion plans across not just Australia, but also cricket-loving overseas markets like New Zealand, India and the UK as it pushes to have $1bn in funds invested by 2030 and then a whopping $4bn by 2037. They are ambitious plans, but Straight Bat’s managers insist its strategy of eschewing a stereotypical “crash and bash” private equity investment style of buying and flipping assets within a few years for longer partnerships built over decades will pay off.

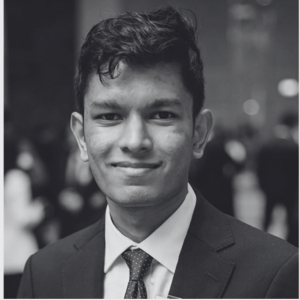

Straight Bat is backed by Flight Centre co-founder Geoff Harris and his family office, run by son Brad Harris, and several other well-known individuals and families on The List – Australia’s Richest 250, and has just clinched its seventh investment.

The firm has about $250m funds under management and has just bought a large stake in Melbourne-based Kase Building and Restoration Group, a privately-owned specialist building and property insurance repairs firm.

Kase is no cool software or artificial intelligence start-up with a flamboyant founder which burns through cash and is years away from even getting close to making a profit.

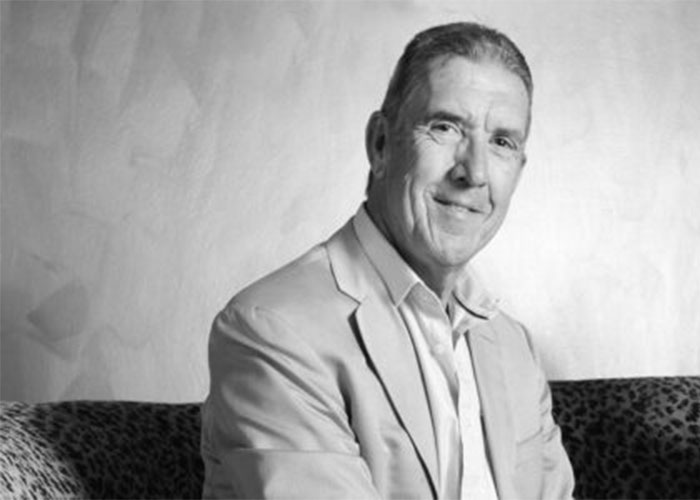

Which is exactly why Straight Bat likes it, according to managing partner Steve Gledden.

“This is meant as a compliment: we often think of them as unsexy businesses that think of them as unsexy businesses that quietly do stuff that nobody notices that underpin our quality of life.

“They’re not rocket ships. They can’t be doubled and tripled in size in three years or five years by doing unnatural things. But if you just run them well, and do the right things in the long term, they’re great businesses.”

Kase joins a Straight Bat portfolio which already has six other investments, including traffic management business RPM Hire, plumbing and drainage firm Toner Group, Red Smoke Alarms and law firm Wotton + Kearney.

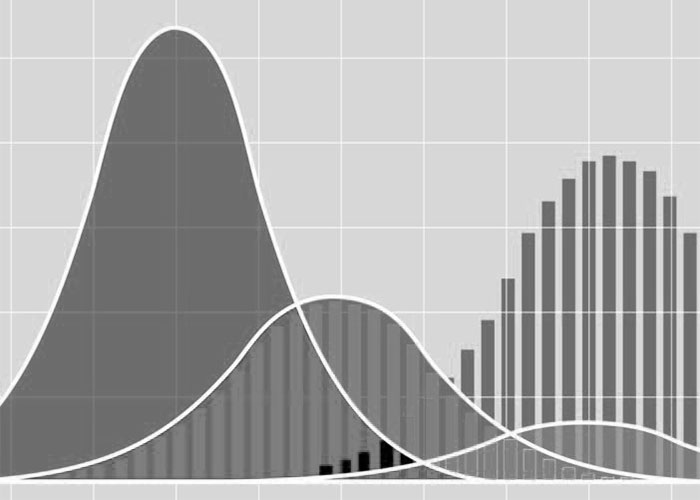

They are all in the sweet spot of Straight Bat’s investment portfolio, with annual revenue between $10m-$100m, earnings before interest and tax, depreciation and amortisation of $5m-$25m and EBITDA margins greater than 20 per cent.

So far, the strategy has been successful for Straight Bat’s investors, typically cashed-up individuals and family offices. “Those seven businesses, if you were to roll them all up together, they turn over $290 million. And they make $75 million in EBITDA,” Gledden says.

“So if that was one company, it’d be pretty valuable. We own 49 per cent of those assets, they will pay dividends, and that will result in our investors getting 12-13 per cent total income return this year, including franking credits, after our fees. And they get steady capital growth as well. They got a 10 per cent increase in the unit price this year.”

Kase and the other Straight Bat businesses operate in what Gledden calls the “engine room” of the Australian economy other private equity outfits don’t field in. It is not the billion-dollar businesses that giants like KKR and Blackstone look at or the mid-market firms such as Crescent Capital and Mercury Capital. Nor is it an approach of bringing in new management teams, putting in equity and quickly growing EBITDA and selling out on higher earnings multiples.

Instead, Straight Bat looks at the 52,000 businesses in the mid or lower market and only takes 49 per cent equity in profitable firms and typically pays three to five times earnings multiples. “We’re an income-oriented private equity fund that plays the long game. We basically invest in mature, robust, highly profitable, medium sized businesses that we’re happy to own forever,” Gledden says. “We do that for two reasons. I mean, the first “We do that for two reasons. I mean, the first is kind of obvious, they’re profitable and highly cash generative, they can pay dividends. But the second is a little bit less obvious, is that their [profit] margin is usually indicative of some sort of competitive advantage.”

Gledden says Straight Bat’s investment strategy is like a “50/50 partnership, like a cricket innings with batsmen” where the firm doesn’t try to tell the company’s founder what to do but “tries to wrap our arms around them and not let them fail.”

Straight Bat’s investments are for the long-term and Gledden uses the analogy of Flight Centre, built up patiently over four decades by Harris and co-founders Bill James and Graham Turner, with all three still major shareholders today as proof of Straight Bat’s management acumen. Other Straight Bat backers include Bill James. PFD Food Service billionaire founder Richard Smith and his son Lindsay, who sits on the firm’s investment selection committee, on the firm’s investment selection committee, Boost Juice founder Janine Allis (Harris was one of the original backers of Boost), Wingate founder Farrel Meltzer, former Foster’s CEO Trevor O’Hoy and property magnate Steve Buxton.

“What we’re doing is giving support to a business owner who has built something valuable, and they might take $20m to $30m or $40m off the table — but they’ve got 10 or 20 years left in the tank. So, they get to go on that journey, but guess what, they’ve got Geoff Harris as a shareholder. And he’s a handy chap to have in your corner,” Gledden says.

With Kase, it has a 36-year-old founder in Kurt Saunderson, who says the investment from Straight Bat will help his business in “expanding into new markets, attracting top-tier talent and develop advanced solutions to streamline and enhance dealings with clients, insured parties, subcontractors, and various stakeholders”.

Gledden says Straight Bat expects to deploy about $100-150m in capital in the next 12 months about $100-150m in capital in the next 12 months, with its next major acquisition slated for mid-2024 and funds coming from a waitlist which already has a substantial portion earmarked from existing investors.

After that, it will be time to look further afield.

“By the year 2037, you know, we think we’ll be at $4 billion in funds under management. We will have three or four funds,” Gledden says. “Now, our brand is not going to play in the US. They will not get Straight Bat. But we’re already looking in New Zealand, I can see us having a fund in the UK. And I can see a fund in India as well.”