Play the Long Game

Straight Bat is an income oriented private equity fund that plays the long game. We invest in mature, robust, profitable, medium sized Australian businesses for slightly old fashioned reasons – income, wealth preservation and sustainable capital growth.

What do we invest in?

We invest in mature, robust, profitable, Australian businesses, that specifically generate:

Revenue

$10-250m

EBITDA

$5-50m

EBITDA Margins

20%+

Great innings are

built on partnerships.

Our offering

To Business owners

Partnership

Great innings are built on partnerships. We are all in it together. We won’t tell you how to run your business. We love 50:50 deals but are flexible with minority or majority shareholding.

Long term horizon

We are very patient capital. We invest with an indefinite time horizon and for slightly old fashioned reasons – income, wealth preservation, sustainable capital growth.

Money off the table

You can take money off the table for liquidity and diversification. You will continue to receive regular dividends into the future.

Business Family

When we invest you become part of our business family. We commit to building relationships that endure from generation to generation. Our network is formidable. We have done this before and can help you succeed.

To Investors

High Yield

We aim to deliver a 10%+ net franked dividend yield per annum.

Capital Preservation

Conservative capital appreciation through natural business growth.

Diversification

A diversified portfolio of high-quality medium sized private businesses.

Access to additional opportunities

When you invest you become part of our business family. This includes optional participation in growth, debt and other opportunities that emerge from the portfolio.

Long game and income. In the end, family is the reason why we do this.

Our values and beliefs

We believe in fair play, in “having a crack”, the power of optimism, persistence, self-reliance and hard work. We believe in going into business with people we are comfortable having a “beer” with and that there’s more to life than money. We believe in having a good time, and that in the end, family is the reason why we do this. Play the long game…

-

All in it

together -

Straight

Bat -

Have a

crack -

Balance

168

At Straight Bat we are “all in it together”. Great innings are built on partnerships. When we go into partnership we become “business family”. We negotiate fair agreements that we will both be proud of in 10 years-time.

We are egalitarian and fair. Everyone in the team has a role to play – everyone is important and must be treated with respect. We are inclusive, respect difference and value diversity. We think about what is means to be a “good mate”.

We take responsibility for our behaviour and expect the same from those we deal with. To be successful we all have to “turn up to training”, “pitch in”, “roll up our sleeves”, work hard and support one another. We value people who are high achievers AND team players. We all benefit in the long run when we are “all in it together”.

We play the long game with a straight bat. We believe in the principles of a “handshake” deal. This means be your word, do what you say. Conduct yourself with authenticity, honesty and integrity.

We bring a 50:50 partnership mindset. We are fair with our team and in our business dealings. The best business deals are always a “two-way street”.

We tend to prefer a simple, low-key approach. It’s great to hit “fours” and ”sixes”, but games are usually won by consistently notching up “singles”.

We like to invest in good old-fashioned businesses, that quietly do simple things well – mature businesses, diversified customers, long term contracts, well understood products and business models, high margin, modest growth.

Our reputation is important, so we think carefully about our conduct, play the long game and play it with a straight bat.

It takes courage to “have a crack”.

We are entrepreneurs. We see possibility. We are made from optimism, persistence, self-reliance and hard work.

When you play the long game, having a crack, doesn’t mean being careless – it’s important to understand “which ball to let through to the keeper and which to put over the fence”.

We strive to show leadership in business and our community. We seek to empower people to make it happen. We believe in taking responsibility for ourselves and supporting others in our community to have the same opportunity.

At Straight Bat we recognise that there are 168 hours in the week.

We are responsible for balancing work, family, health, and personal passions. We believe that hard work results in achievement and satisfaction, but there is more to life than work and it’s not all about money.

It’s important to have fun. We try not to take ourselves too seriously.

It’s important to maintain perspective. We look for people who have a balanced approach and who’s company we enjoy – is this someone I want to have a “beer” with?

- All in it together

- Straight Bat

- Have a crack

- Balance 168

At Straight Bat we are “all in it together”. Great innings are built on partnerships. When we go into partnership we become “business family”. We negotiate fair agreements that we will both be proud of in 10 years-time.

We are egalitarian and fair. Everyone in the team has a role to play – everyone is important and must be treated with respect. We are inclusive, respect difference and value diversity. We think about what it means to be a “good mate”.

We take responsibility for our behaviour and expect the same from those we deal with. To be successful we all have to “turn up to training”, “pitch in”, “roll up our sleeves”, work hard and support one another. We value people who are high achievers AND team players. We all benefit in the long run when we are “all in it together”.

We play the long game with a straight bat. We believe in the principles of a “handshake” deal. This means be your word, do what you say. Conduct yourself with authenticity, honesty and integrity.

We bring a 50:50 partnership mindset. We are fair with our team and in our business dealings. The best business deals are always a “two-way street”.

We tend to prefer a simple, low-key approach. It’s great to hit “fours” and ”sixes”, but games are usually won by consistently notching up “singles”.

We like to invest in good old-fashioned businesses, that quietly do simple things well – mature businesses, diversified customers, long term contracts, well understood products and business models, high margin, modest growth.

Our reputation is important, so we think carefully about our conduct, play the long game and play it with a straight bat.

It takes courage to “have a crack”.

We are entrepreneurs. We see possibility. We are made from optimism, persistence, self-reliance and hard work.

When you play the long game, having a crack, doesn’t mean being careless – it’s important to understand “which ball to let through to the keeper and which to put over the fence”.

We strive to show leadership in business and our community. We seek to empower people to make it happen. We believe in taking responsibility for ourselves and supporting others in our community to have the same opportunity.

At Straight Bat we recognise that there are 168 hours in the week.

We are responsible for balancing work, family, health, and personal passions. We believe that hard work results in achievement and satisfaction, but there is more to life than work and it’s not all about money.

It’s important to have fun. We try not to take ourselves too seriously.

It’s important to maintain perspective. We look for people who have a balanced approach and who’s company we enjoy – is this someone I want to have a “beer” with?

Our Team

Investment Team

Managing Partner

Steve brings 30 years’ experience as a business owner, operator and investor in a broad range of sectors including industrial services, life sciences, manufacturing, banking, resources, media, software & technology, private equity and venture capital.

- Private Equity & Venture Capital advisor and investor across the UK, USA and AUS

- Extensive operating experience from small to large venture backed, private and public companies.

- 30 years’ experience, involvement in >50 transactions and capital raisings, >$10 billion transaction values

- McKinsey & Co, Idealab, Venture Capital Partner

- BCom/B.Sc Melbourne University, MBA Oxford

Steve is a keen fisherman, sailor, golfer, skier and pilot. He believes “we don’t ‘live to work’, we ‘work to live’”.

Senior Partner

Rob has operating and finance experience including a deep understanding of debt and equity transactions where he has led and closed transactions in excess of $5b. He is a wise and talented mentor for senior managers and business owners seeking to grow sustainable businesses.

- 20+ years with Westpac – Head of Westpac’s $200m Direct Equity Fund, Head of Institutional Bank Vic, Head of Private Bank Vic

- National Head Origination GE Capital Corporate Finance

- 9 years as Chairman and then CEO of Nationwide Towing

Career highlights include growing Nationwide Towing into 3 states before a trade sale to RACV with substantial value accretion and leading bank funding for Visy’s company transforming acquisition of Southcorp Packaging.

Rob is a huge cricket fan, famously a “mono-tasker” and loves driving the team to focus on the “meat and potatoes” (getting stuff done).

Senior Partner

Matt has more than 15 years of experience as an investment banker, private equity advisor and business executive.

His advisory experience, gained at Goldman Sachs, UBS and KPMG, includes transactions involving the following private equity firms: Affinity Equity Partners, Archer Capital, Bain Capital, Baring Private Equity, Carlyle, EQT, KKR, L Catterton, Mercury Capital, Pacific Equity Partners, PAG Asia, Permira, Quadrant, Silver Lake Partners and TPG.

His experience in operating or investing businesses includes:

- Goldman Sachs Private Equity division

- AirTree Ventures (venture capital fund)

- M.H. Carnegie & Co (private equity fund)

- TEG Ticketek

- One Cent Flights (digital marketing and rewards platform)

- Cold Drip Beverages (beverage contract manufacturer)

Senior Partner

Jovita brings 20 years of experience as an advisor and executive leader on over $50b in M&A transaction value across 100+ deals, in addition to creating A$800m in EBIT benefit across many transformations with management teams. Her experience spans many industries including industrial manufacturing, health care, tech and retail.

- Transformation lead – Chief Strategy & Innovation Officer at Abano, a BGH Ontario Teachers Pension Fund Dentistry roll up, creating the largest trans-tasman corporate Dental group

- McKinsey & Co Asia Pac Growth Transformation lead

- 7 years as Deloitte Corporate Finance and Consulting Partner – M&A consulting, 2 years with PwC setting up Deal Services Team and working on 20+ deals

- B. Business Mgmt/B. International Trade, Masters in Business Systems from Melbourne University

Jovita is married to university sweetheart Sam, with 3 kids, enjoys the trampoline with the kids, dark chocolate, red wine and good steak. She is part of a large noisy Polish family and loves all things business.

Managing Director

Ze’ev is an accomplished business builder and private equity investor with experience in consumer finance, manufacturing, consumer goods, commodity trading, brand and software development. Ze’ev founded and successfully exited two businesses and is an ardent and inspiring investor.

- Wingate

- BA/Liberal Arts, MoM/Finance MBS, University of Melbourne.

Ze’ev is passionate about playing the long game. When he reflects on his cricketing career, as an opening batsman, he wasn’t known for scoring the most runs, but prided himself to hold up an end and build long partnerships.

Senior Director

Richard brings 15 years of diverse experience as both an operator and advisor in investment, strategy, and business operations capacities. Richard has advised clients across a range of sectors including BHP, NBN, Caltex, Telstra, Transfield, and numerous state and federal government departments such as Defence, Health and Education.

Richard’s operating and advisory experience includes roles at:

- BP

- Asahi

- Ernst & Young

Richard understands very fundamentally how to manage capital investment programs, quiet “sheep dog” leadership and how to make change happen. He believes that regardless of who is on strike, great partnerships lead to long and successful innings.

Director

Sam is a deeply experienced executive with both functional and leadership experience in Australia and the UK. She has spent the last 5 years leading a 24×7 national business with a 450 person workforce.

Sam has functional expertise in Operations, Quality Assurance, WHS, Marketing, Call Centre, Transport Dispatch, Contractor Management, Fulfilment, Supply Chain; and Technology Adoption and Transformation. She brings a unique capability and highly collaborative work style coupled with a deep understanding of how business works.

Sam’s experience includes:

- 15 years in the transport industry at Nationwide Group

- 2 years at UK based apparel & fashion group ME+EM

Sam is an extraordinarily talented executive and leader. She is values-driven, has deep conviction about unleashing business potential and thrives on achieving great things with great people.

Senior Director

Shaun is an impact-oriented transformation partner with 15+ years of experience with a focus in manufacturing, consumer/retail and financial services sectors. He has deep experience leading large-scale transformations and performance improvement programs, specifically in operations, future-proof operating model design and improving customer experience.

Shaun’s experience includes:

- Advised 25+ ASX200 companies; 6 Transformation programs in the past 5 years that identified $2b+ and delivered $400m+ in EBITDA improvement

- Prior roles with McKinsey & Co as a leader in the operations and consumer practices, Ernst & Young, GRA, Rylson Group and Hatch

- Grew up working in a family-owned wholesale seafood business

- B. Mechanical Engineering, B. Commerce, University of Queensland

Shaun is recognised for his ownership mindset, desire to roll up his sleeves and get the job done, and his passion for building winning teams.

Director

Terry has 20+ years of experience as an executive, leader, and adviser across both private and public sectors, throughout Asia-Pacific. He has deep experience in manufacturing, healthcare, industrials, aviation, defence, and private equity.

Terry’s experience includes:

- Executive/senior management in two Australian private equity owned companies

- Executive and board director in an electronic component manufacturing company in Asia

- 5 years’ advisory experience with McKinsey & Co and Monitor Deloitte, specialising in whole-of-lifecycle M&A, operations and strategy implementation

- 14 years in the Royal Australian Air Force as an Aeronautical Engineering Officer

- BE (Aero) Hons and M.Mgmt Studies UNSW, MBA Melbourne Business School, and GAICD Australian Institute of Company Directors .

Terry is part coach, part 12th man, being the support act to our management teams and coaching them to be at their best.

Director

Tim is an experienced commercial leader and executive coach with a career spanning consulting, tech, and private equity. He has led high-performing sales and enablement teams across APAC, managed multi-million dollar P&Ls, and helped global organizations transform how they go to market.

Tim partners with portfolio companies to unlock revenue growth by improving sales productivity, strengthening marketing strategy, and building scalable commercial engines. He bring an operator’s mindset to value creation — hands-on, practical, and long-term focused.

Chief Financial Officer

Kim brings 15 years of accounting and finance experience in a broad range of sectors including manufacturing, hospitality & tourism, investments and property development, with international exposure.

For the past 8 years, Kim has worked for large private family offices as CFO, responsible for large investment holdings across venture capital, private equity, property & operating businesses.

She holds an undergrad in Business Accounting & Marketing, Masters in Commerce (Professional Accounting) and an Executive MBA.

Kim has held multiple Board and Committee positions, providing a high level of financial acumen, specialising in strategic business growth and scenario based modelling.

Associate Director

Yash brings 8 years of experience in corporate finance and investment banking, including roles at Moore Australia, Bletchley Park Capital and Tresvista.

Across his roles, Yash has:

- Advised global private equity funds and investment banks (Michael Dell Capital, Alta Semper, Awad Capital) on sell-side and buy-side deals across telecommunications, retail, FMCG and industrials

- Advised ASX-listed microcaps on capital raisings and M&A, advised private Australian businesses on capital raisings and business sales.

Yash holds a Master of Professional Accounting, Bachelor of Business Administration and a Graduate Certificate in Applied Finance. Yash has composure beyond his years, enjoys reminding the team when India beats Australia in the cricket and fundamentally believes in the philosophy of playing the long game with long-term people, creating value for all in the process.

Senior Associate

Sean has over 5 years of experience in corporate finance and transaction advisory, having commenced his career in the Corporate Finance team at RSM Australia.

Previously, Sean has:

- Advised clients on mid-market sell-side and buy-side transactions across the industrials, technology, health care, and energy sectors

- Advised private Australian businesses on capital raisings and IPOs

Sean holds a Bachelor of Commerce from the University of Melbourne. He loves to settle in at the crease, “have a crack” and work diligently with our partners to play the long game.

Senior Associate

Jakub brings over 5 years of experience across a range of industries, including 2 in M&A and International Tax advisory at PwC Australia.

In his roles, Jakub has:

- Advised on 18 buy-side & sell-side deals with an aggregate value A$5B+, with a particular focus in industrials and fintech industries

- Advised multinational and ASX-listed organisations on debt restructures and their financing arrangements

- Led a not-for-profit consulting, 180 Degrees Consulting, for several years at Monash University

Jakub holds a Bachelor of Laws (Honours) and a Bachelor of Commerce from Monash University.

Associate

Sam has over 5 years experience in M&A and transaction advisory, having started his career in the Corporate Finance team at Grant Thornton.

Throughout his time at Grant Thornton, Sam played a pivotal role in guiding mid-market businesses through their M&A experience, also undertaking numerous financial due diligence engagements on both the buy-side and sell-side.

Sam holds a Bachelor of Commerce / Bachelor of Economics double degree from Monash University and is a Full Member of the Institute of Chartered Accounts Australia.

A lover of cricket, Sam knows the value of patience at the crease, consistent line and length and playing with a straight bat.

Fund Operations Manager & Compliance Officer

Becky has over 8 years of experience in fund operations, compliance, custody services, and corporate trust management. She has a proven track record of managing teams, improving processes, and delivering results across share registry, custody, and corporate trust services.

Becky’s experience include roles at:

- GAM Investments

- KPMG

- Northern Trust

- BNY Mellon

- Automic Group

Becky holds a degree in International Business (Spanish) from Dublin City University, complemented with a degree from Universidad Pontificia Comillas in Madrid, and a postgraduate degree in International Fund Management from University College Dublin.

Analyst

Joachim has over 4 years of experience working in operations and transactions for PE-owned businesses in IT, healthcare, and financial services across Scandinavia and Australia.

Joachim’s hands-on experience within portfolio companies equips him with the ability to dive into the details, tackle challenges, and get things done.

Joachim holds a Bachelor of Business Administration and a Master of Finance & Accounting from Copenhagen Business School.

Like any Norwegian, Joachim loves skiing and had never seen cricket before moving to Australia. He now embraces the sport and is fully committed to play the long game.

Analyst

Josh has over 2 years of experience in management consulting, having commenced his career at Deloitte within the Transformation & Technology practice.

Josh’s experience includes:

- Advising ASX200 clients across sectors including Financial services, infrastructure and real assets, technology, industrial services as well as Government and higher education

- Delivering engagements spanning strategy, performance improvement, and large-scale transformation programs.

Josh holds a Bachelor of Commerce and Bachelor of Economics from the University of New South Wales. A safe pair of hands, he knows that success is built one play at a time.

Head of Talent

Pauline’s career in human resources has spanned many years and encompassed both the public and private sectors. It has included working with large corporates and SME’s, as well working in a consulting capacity for more than a decade.

With a focus on company and talent experience, Pauline routinely delights our portfolio companies, by running a transparent recruitment process, underpinned by timely communication. Our portfolio companies have usually never had access to these skills without having to pay substantial fees.

Pauline brings a collaborative and adaptable approach to her role, keenly focussed on contributing to the achievement of business goals. She is a “dyed in the wool” Collingwood fan, runs our footy tipping competition and is frequently a source of laughter in the Straight Bat office.

Assistant

Edralyn brings 6 years experience in admin and customer service roles including at a TeleHealth company and an import and distribution company.

Edralyn Rabuya is a graduate of Bachelors of Science in Nursing and is a Licensed Registered Nurse.

Executive chairs in residence (ECIR)

Executive Chair, HPS Tech

Adam has 20 years of management consulting experience with McKinsey & Company; working across a range of sectors including metals, mining chemicals, manufacturing, telecommunications, retailing, banking and government. He was the managing partner for Australia & New Zealand from 2002 to 2008.

Adam was the Chairman of Aconex (sold to Oracle for $1.6bn) from 2014 until 2017 and is a NED of direct access bond market specialist FIIG.

Executive Chair, ProviCo

David is an experienced CEO and Executive Director with deep experience in the consumer products and agribusiness sectors. His current and previous experience includes:

- President and Chief Operating Officer of Saputo Dairy Division (Australia)

- CEO and Managing Director of Warrnambool Cheese & Butter Factory Company Limited, overseeing its sale to Saputo Inc.

- Non-Executive Director of Ridley Corporation and interim CEO

- Non-Executive Director of Dairy Australia Corporation the peak services body to the dairy industry.

Selection Committee

Geoff is a co-founder of Flight Centre. Geoff has made dozens of private equity and debt investments, including being the first investor into Boost Juice, which was successfully sold to Riverside Private Equity.

Geoff is an enthusiastic Hawks supporter and served as Vice President of the AFL football club from 2008 to 2013 .

He has extensive philanthropic interests developing affordable housing and supporting disadvantaged kids, including social enterprise STREAT and Reach Youth in Collingwood.

After almost 33 years service, Trevor O’Hoy left Foster’s Group in 2008. Commencing in 1976 as a cadet executive his career at Foster’s included the roles of Managing Director of CUB and Chief Financial Officer of Foster’s and culminated in being appointed Chief Executive Officer of Foster’s in 2004.

Since leaving Foster’s, he has pursued a Non-Executive Director career with past directorships including the Swisse Wellness Group (sold for $1.7 billion), RACV, Cricket Australia, Cricket Victoria, the North Melbourne Football Club, DWS and ASG Group.

Current directorships include Redcape Property Group, Stone and Wood Brewing Company, Maggie Beer Product Company and the Ponting Foundation.

Lindsay is a former Executive Director of Australia’s largest family-owned food services business, PFD Food Services, having worked in various roles in the family business for over 25 years.

Lindsay leads the Smith’s family office and has made a number of private equity investments. Lindsay is a Director in a number of private business investments in the logistics, food manufacturing, building materials industries.

Lindsay joined Johns Lyng Group as Chief Operating Officer in 2005. A degree qualified Civil Engineer and Oxford University alumnus of the Said Business School, Lindsay brings a wealth of experience from a long and celebrated career in construction and project management.

Lindsay leads the day-to-day operations, strategic planning and growth initiatives of Johns Lyng. Lindsay has deep experience in all facets of the construction industry, having worked in the private sector for Tier 1 Contractors like construction giant John Holland, through to Tier 2 & 3 Contractors on all types of projects encompassing all types of construction, Design and Construct, and Development projects.

Board

Farrel founded Wingate in 2004 after a successful career as an investment banker, including positions as head of ANZ Private Bank and Group Managing Director of Investec Bank (Australia) Ltd.

Through Wingate, Farrel has been involved in more than 100 deals including both private equity and private credit investments.

Steve brings 30 years’ experience as a business owner, operator and investor in a broad range of sectors including industrial services, life sciences, manufacturing, banking, resources, media, software & technology, private equity and venture capital.

- Private Equity & Venture Capital advisor and investor across the UK, USA and AUS

- Extensive operating experience from small to large venture backed, private and public companies.

- 30 years’ experience, involvement in >50 transactions and capital raisings, >$10 billion transaction values

- McKinsey & Co, Idealab, Venture Capital Partner

- BCom/B.Sc Melbourne University, MBA Oxford

Steve is a keen fisherman, sailor, golfer, skier and pilot. He believes “we don’t ‘live to work’, we ‘work to live’”.

Brad’s commercial experience is diverse, having been involved in organisations spanning Hospitality, Technology, Property development, Asset Management, Funds Management, Politics, Advisory, Professional Sports and Healthcare.

Brad is a serial entrepreneur, he has founded 5 successful businesses and sits as a Director on the board of four charitable organisations including the Epworth medical foundation and the Hawthorn Football club foundation.

- Straight Bat Private Equity – co-founder, Partner & Director

- Mosaic Private Credit –co-founder and IC member

- Signature Hospitality Group – co-founder and Director

- H.CO Property – co-founder and Director

- Harris Capital – Founder & CEO

Brad was one of Straight Bat’s two opening batsmen, his role encompasses governance, strategic direction and investment decision oversight. He believes in the principle of a handshake deal and playing the long game.

Rob has operating and finance experience including a deep understanding of debt and equity transactions where he has led and closed transactions in excess of $5b. He is a wise and talented mentor for senior managers and business owners seeking to grow sustainable businesses.

- 20+ years with Westpac – Head of Westpac’s $200m Direct Equity Fund, Head of Institutional Bank Vic, Head of Private Bank Vic

- National Head Origination GE Capital Corporate Finance

- 9 years as Chairman and then CEO of Nationwide Towing

Career highlights include growing Nationwide Towing into 3 states before a trade sale to RACV with substantial value accretion and leading bank funding for Visy’s company transforming acquisition of Southcorp Packaging.

Rob is a huge cricket fan, famously a “mono-tasker” and loves driving the team to focus on the “meat and potatoes” (getting stuff done).

News

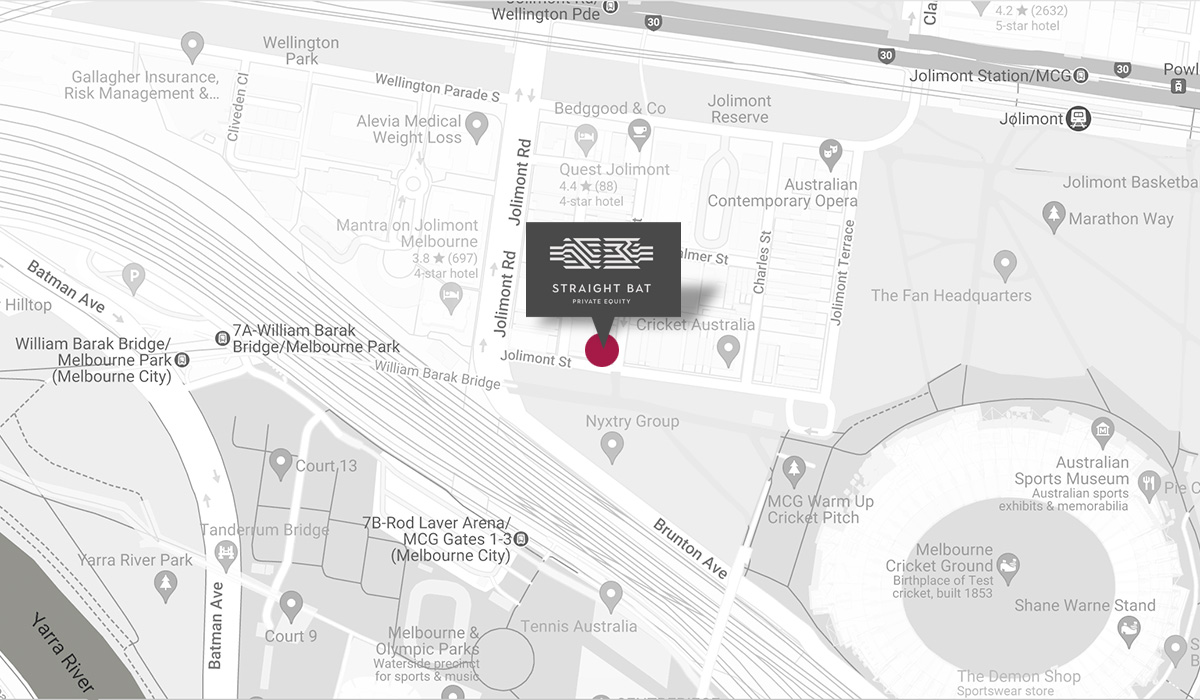

Straight Bat Private Equity

Level 5, 88 Jolimont Street,

East Melbourne VIC 3002

Google Map